Home buyers can once again expect to be dogged by the lack of inventory in the housing market.

We have witnessed a period of relative quiet since last fall, when many home buyers and sellers seemed to take a sabbatical from real estate. Interest rates were on the way up and consumers took the opportunity to pause their buying and selling activities to see what would happen next.

But now, with the succession of interest rate hikes behind us and more house hunters re-entering the market, demand is once again outweighing supply. Buyers are facing competitive offer situations in more and more suburbs as we get deeper into the spring market.

This is putting upward pressure on pricing, and placing home sellers back in the driver’s seat.

Let’s take a look at what happened in home prices between January and April in Oakville, Milton, Burlington, and Mississauga, and what this may mean for home buyers.

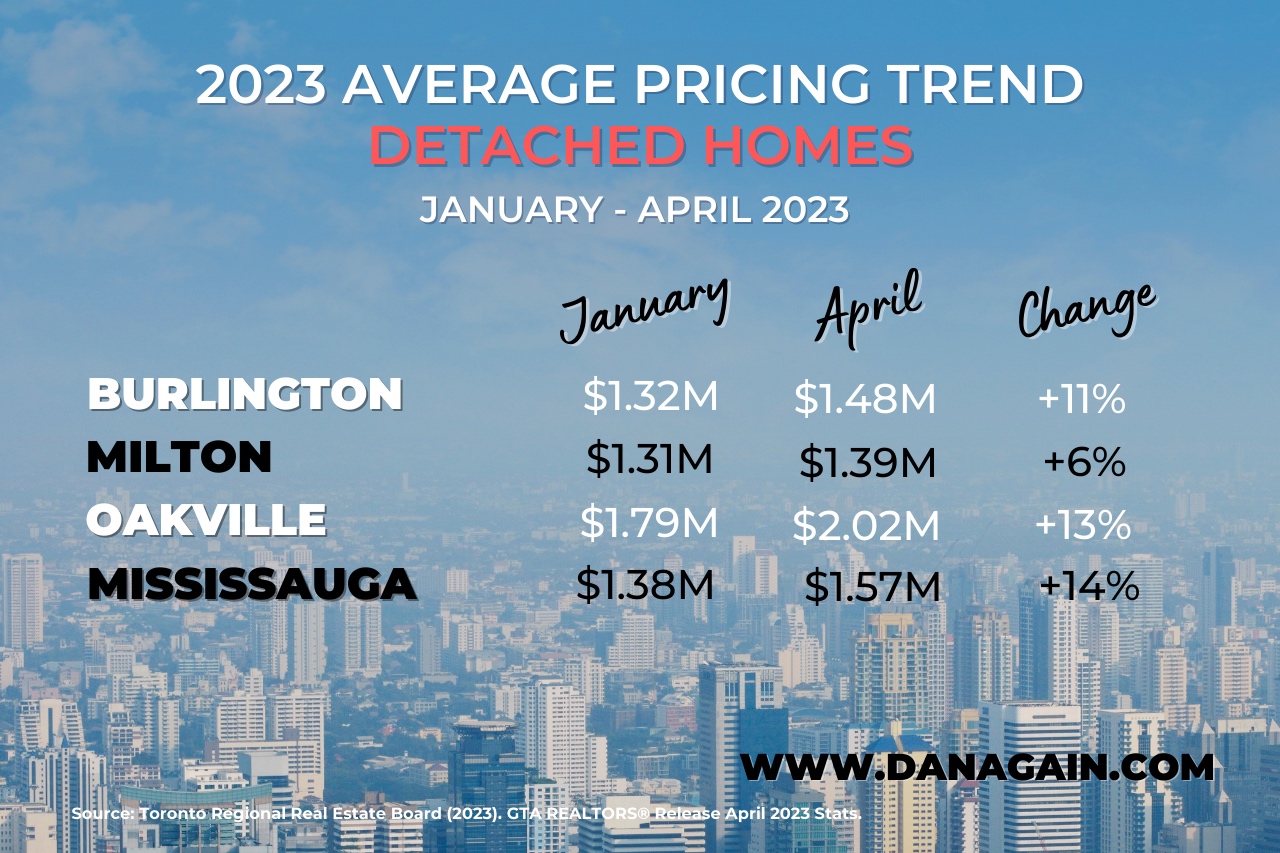

Detached Homes

All western GTA suburbs showed strong increases in average selling price for detached homes between January and April 2023.

Burlington detached homes were selling for just over $1.32M in January of this year. By April, this had climbed to a more promising $1.48M, an increase of 11% over the 4-month period.

Milton's increase was less impressive than Burlington at just over 6% over the same timeframe. Detached homes selling for $1.31M in January were fetching nearly $1.4M by the end of April.

Oakville detached homes demonstrated a similar trend to Burlington, with a 13% increase in average selling price between January and April. Detached homes selling for $1.79M in January in Oakville had risen to just over $2M by the end of last month.

Mississauga showed the strongest increase in selling price over the same period, 14%. Detached properties in this closer suburb of the GTA selling for $1.38M in January had risen to $1.57M by the end of April.

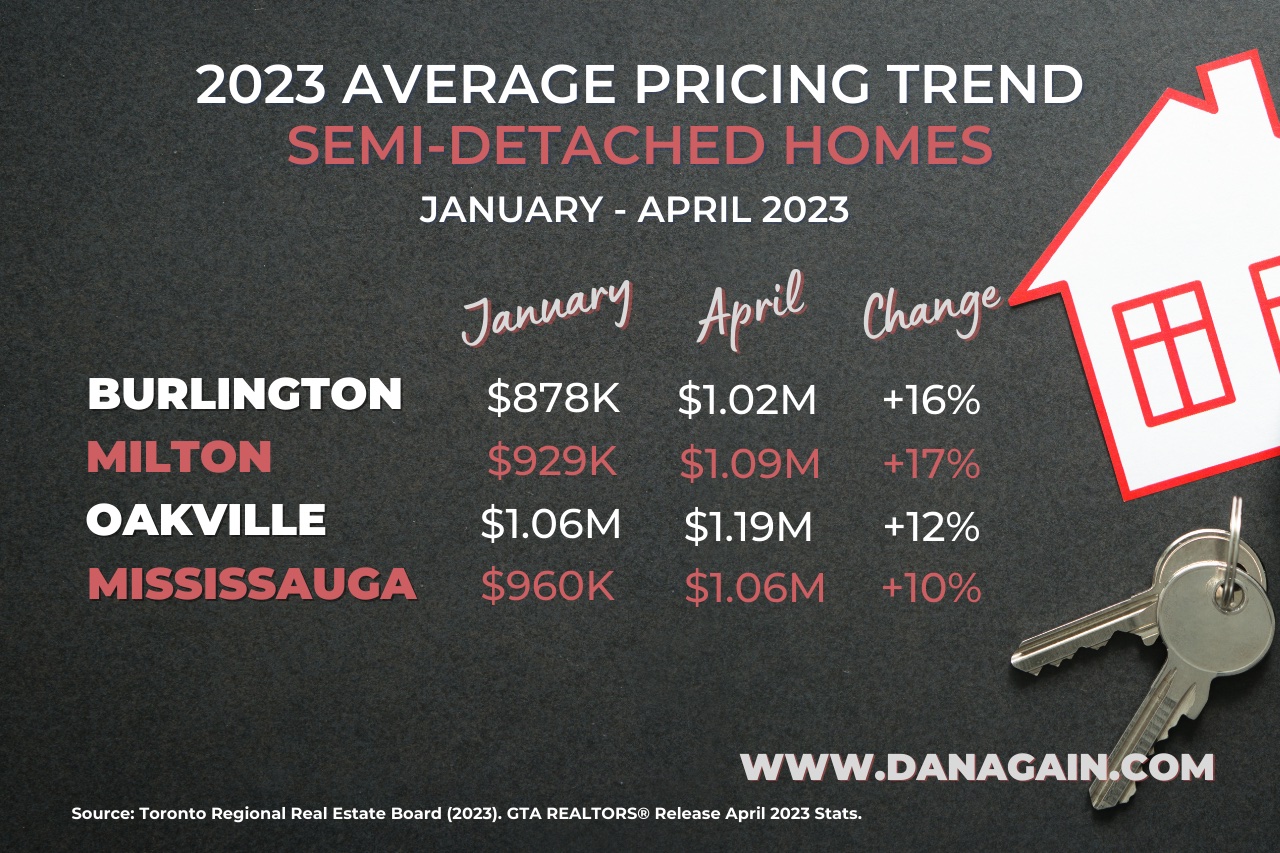

Semi-Detached Homes

Noticeable increases were also seen in the semi-detached segment between January and April of this year.

January's $878,000 average price in Burlington jumped to $1.02M by the end of April 2023, an increase of 16% in average selling price.

Semi-detached homes were also very popular in Milton during this timeframe, moving from $929,000 in January to $1.09M in April, a 17% increase.

Still impressive but lower than the other regions, Oakville's semi-detached market moved from $1.06M in January to $1.19M by the end of April, a 12% increase.

Mississauga's semi-detached popularity grew as well, but more slowly that the other areas. Homes selling in January for $960,000 in Misssissauga were fetching $1.06M by the end of April, a 10% increase in average selling price.

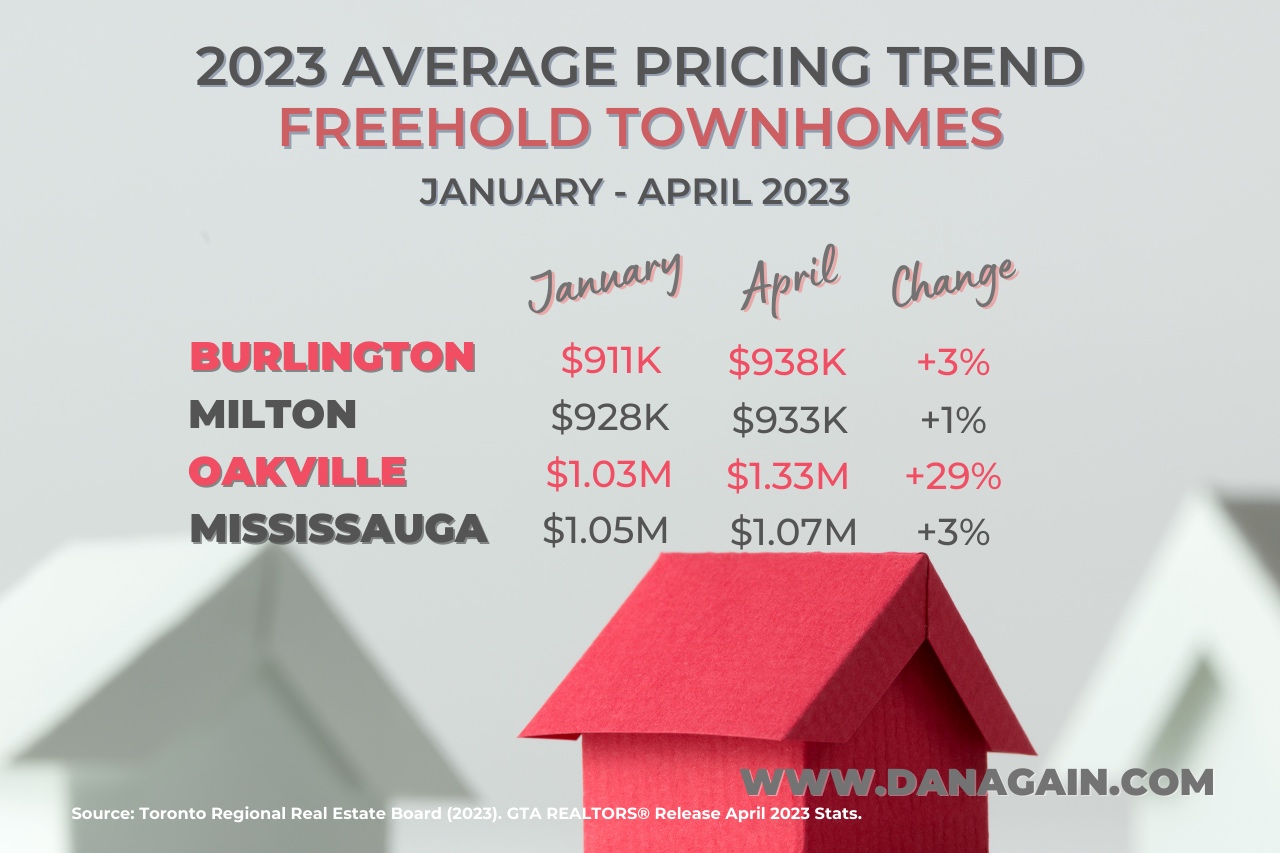

Freehold Townhomes

Moderate increases were seen in average home prices for freehold towns between January and April, 2023.

In Burlington, Oakville and Mississauga, the average price of a freehold townhouse increased between 1 and 3% between January and April of this year.

Burlington's average price increased by $27,000 during the period, Milton's just $5,000, and Mississauga's price increased by just $20,000.

However, Oakville had a strong increase in average price during the same timeframe. While this 29% increase is most certainly an anomaly (eg. extreme high or low numbers at the front or back end of the calculation), it's clear that the price improvement in this very popular suburb is worth noting.

Anecdotally, our clients shopping for freehold towns in Oakville during this period often had a hard time getting in to view a property before it sold. Many sold firm in a matter of 1-4 days, and most often these homes were selling to multiple offers.

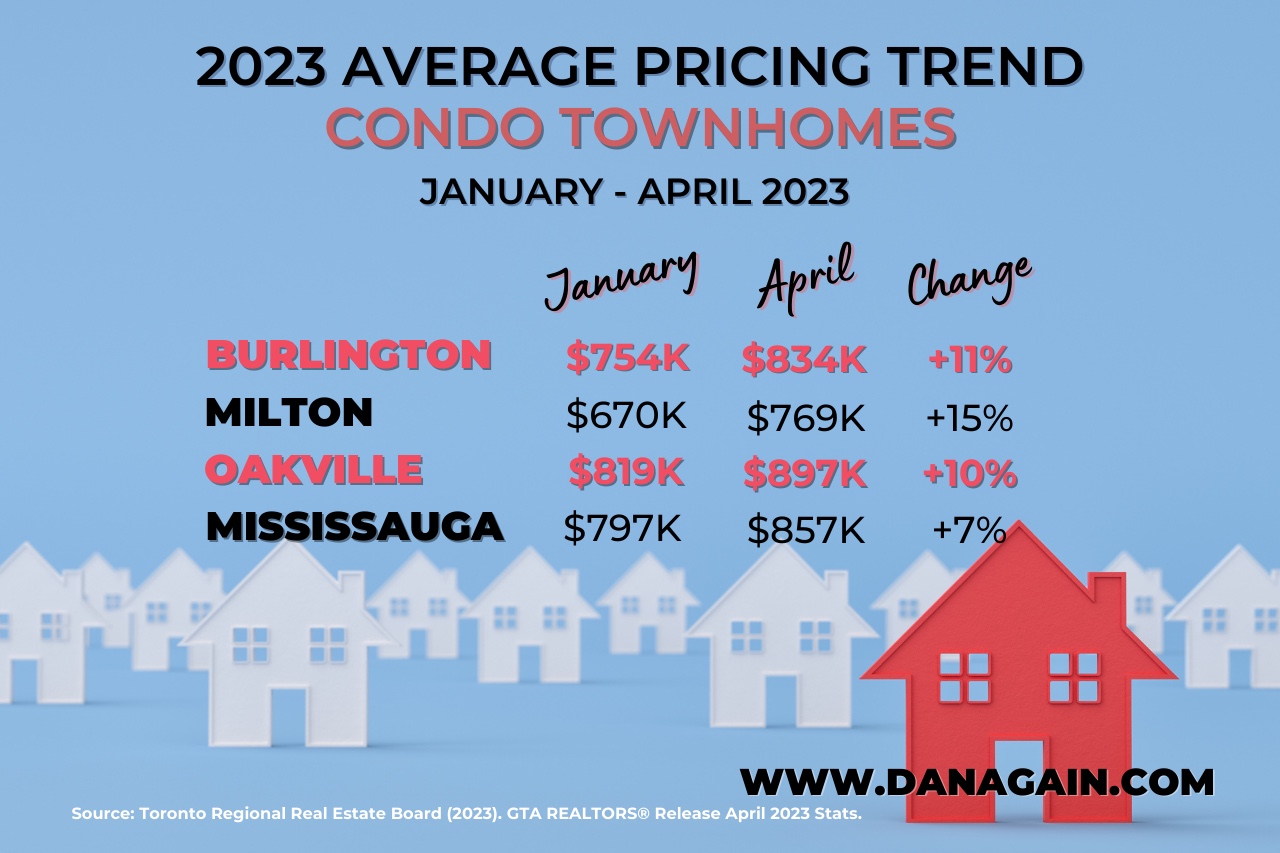

Condo Townhouse

Perhaps due to relative affordability of this segment relative to freehold, condo towns showed strong average price increases between January and April.

Even at the modest end of the scale, these GTA suburbs had healthy increases during this period.

Mississauga condo towns increased from $797,000 in January to $857,000 by the end of April. Oakville and Burlington showed 10% and 11% average price increases, respectively, amounting to an $80,000 sale price increase during the same period.

Milton showed the highest increase of all in average sale price. Condo towns selling for $670,000 in January had rocketed up to $769,000 by April, a 15% increase in just a few months.

Condo Apartment

Most notable about condo apartment sales between January and April was the inconsistent results amongst the suburbs.

Milton saw just a 1% increase, while Mississauga average pricing for condo apartments rose by 5%, and Burlington by a full 11%. At the other end of the scale, Oakville average pricing for this market dropped 25% during the same period.

The same reasoning applies here as in the large increase seen in freehold townhomes. There will be some mitigation to this number, however the downward trend is worth noting nonetheless.

What Do The Numbers Mean?

So, what are the implications of rising home prices into the spring of 2023?

First, the market correction we saw in the past 3 quarters of 2022 was not insignificant. In most suburbs of the GTA, home prices fell to 2021 levels or just below. As such, part of the increase in home values being seen now is partly a rebound effect after a less than active fall and winter season.

Second, the numbers included here from the Toronto Regional Real Estate Board (2023) are average prices within each segment. Some homes sold for less, others sold for more. The point in using average prices is that it allows us to see trends across municipalities, and get a sense of what's happening in the market.

However, even after taking these caveats into consideration it is clear that the housing market is well on its way. The indications are positive, compelling, and mostly consistent across the 4 suburbs.

Anecdotally, in discussions with our clients, the angst that seemed to plague home buyers when interest rates were on the rise has given way to a new consumer acceptance of the status quo. It seems that it was not only the interest rate increase that buyers and sellers found frightening, it was the uncertainty around how long they would continue to rise.

If you are considering re-entering the real estate market as a buyer or seller, contact us today. Lower housing prices are drawing more and more buyers back into the market, and sellers don't have nearly as much competition now as they are likely to have in the coming weeks and months.***

References:

Toronto Regional Real Estate Board (2023). GTA REALTORS® Release April Stats.

Toronto Regional Real Estate Board (2023). GTA REALTORS® Release January Stats.

Subscribe to Monthly Newsletter

Explore More Articles

Daily Listings to Your Inbox

What's Your Home Worth?