It’s one of the last questions asked by home buyers. In a perfect world, it would be among the first.

In fact, it could change your mind about where to live.

How much are the property taxes?

We know the usual suspects when considering a house purchase: down payment, mortgage, closing costs, and completion date. Property tax is not usually given much consideration by a buyer before a purchase, probably because it’s considered a necessary evil.

Taxes are taxes, we must pay them; it is what it is.

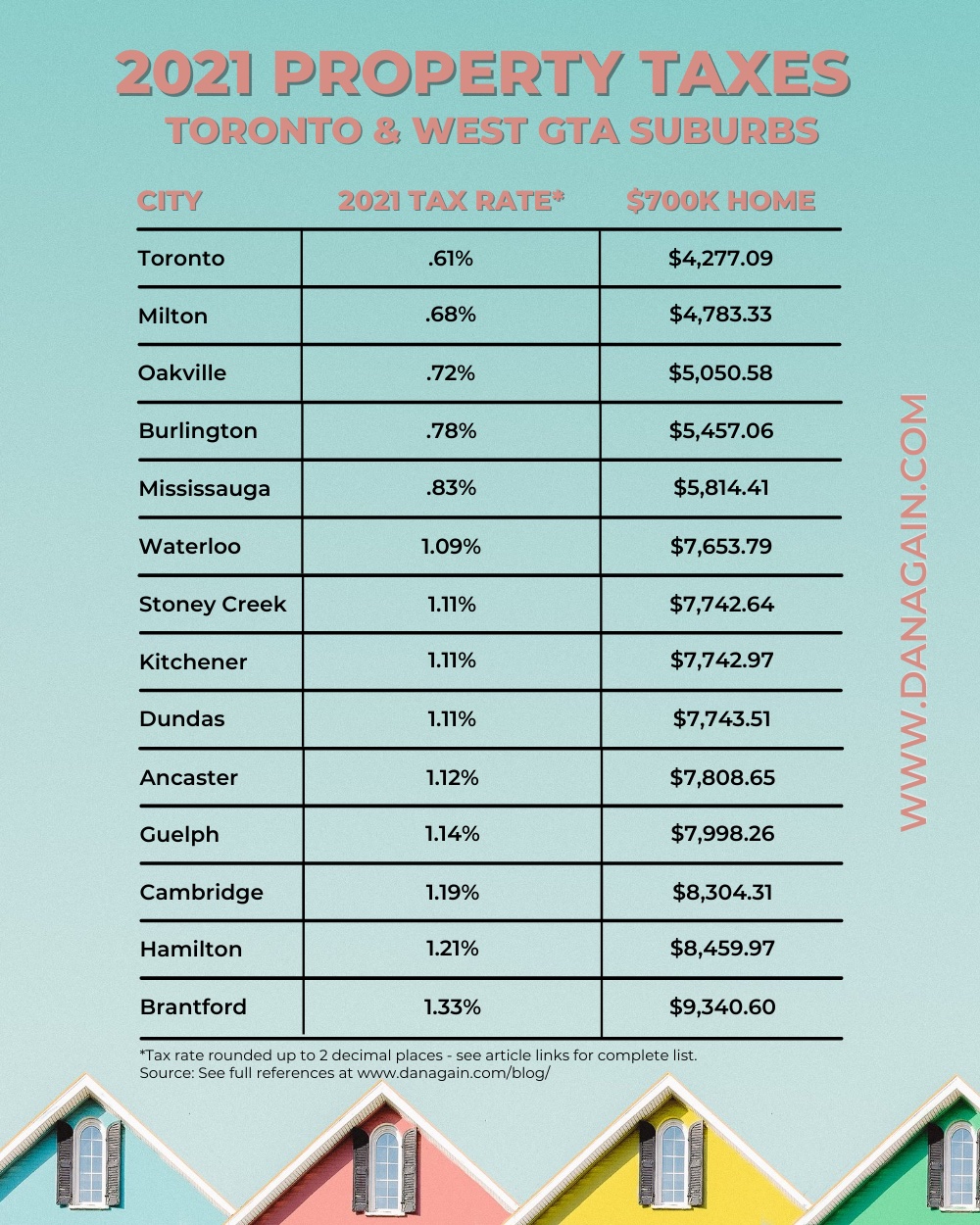

However, it turns out that property taxes in Ontario can vary dramatically between cities. In some, like the City of Toronto, tax rates for 2021 are around .61%. This is among the lowest anywhere in the province. For example, on a $700,000 house in Toronto your property taxes would be around $4277.

Compare this with Brantford’s residential tax rate of 1.33%. The very same $700,000 house in Brantford would be responsible for $9340 in property taxes, more than twice as much as Toronto.

SIDEBAR: Toronto is an unusual case when it comes to taxes. Buying a home in the City of Toronto also means paying twice the land transfer tax on closing – municipal and provincial in equal measure.

However, land transfer tax is paid just once while property taxes are paid annually. Thus, when considering whether to buy in the City of Toronto proper, home pricing notwithstanding, property taxes could potentially be factored into the mix as a positive.

Click here for a Land Transfer Tax calculator.

2021 Property Taxes by West GTA Suburb

In our analysis, we evaluated property taxes in 14 cities west of the GTA (our market area) to see if it might influence a buyer’s decision to move there.

Here are the highlights:

- While Oakville is one of the most expensive cities in the province to buy a home, it has one of the lowest tax rates: 0.72%.

- Spending $1M on a home in Oakville in 2021 required an annual tax payment of $7215, while a $1M home in Brantford would have set you back $13,343.

- Milton also has a very low tax rate at .68%. As one of the more popular suburbs west of the GTA, this could give buyers a whole new reason to consider Milton even with the higher home prices.

- Of the 14 cities we reviewed, the 5 least expensive were Toronto (.61%), Milton (.68%), Oakville (.72%), Burlington (.77%), and Mississauga (.83%).

- The 5 most expensive cities in the west GTA for 2021 property taxes were Guelph (1.14%), Ancaster (1.12%), Cambridge (1.18%), Hamilton (1.21%), and Brantford (1.33%).

Property Tax Calculators & Tax Rates: West GTA

To make it easy to find the information, we have included links for you to all the property tax calculators available for these 14 cities west of the GTA. Some municipalities have a calculator; others post only the tax rates.

Burlington Property Tax Assessment Online Tool

City of Brantford Tax Rates

City of Cambridge Taxation Rates

City of Guelph Property Taxes

Halton Region Property Tax Estimator

City of Hamilton Tax Calculator

Kitchener Property Tax Calculator

Town of Milton Property Tax Calculator

Mississauga Property Tax Calculator

Town of Oakville 2021 Tax Rates

City of Toronto Property Tax Calculator

Waterloo Property Tax Calculator

Importantly, the COVID-19 pandemic has influenced property assessment updates which impacts how much you pay in property taxes. This is important because property taxes are calculated on the assessed value of the home and not on it's current market value.

As a result of the COVID-19 pandemic, the government has postponed the 2020 Assessment Update and will continue to use the January 1, 2016 assessed value for the 2022 and 2023 tax years (MPAC, 2021). The assessment update is normally done every four years; the next assessment will be conducted in 2024 after eight years have elapsed.

If you are looking west of the GTA for your next home, remember that help is available. We can help you understand the costs involved in your purchase, explain how your property taxes are calculated, and ensure you have all the information you need to make an informed decision. Reach out today!***

Reference: Municipal Property Assessment Corporation (MPAC)(2021). COVID-19 Updates For Our Partners.

Subscribe to Monthly Newsletter

Explore More Articles

Daily Listings to Your Inbox

What's Your Home Worth?